I Asked Google’s Gemini AI to Handle Expense Reimbursements

-800x348.jpg)

Hello from Sayu CPA Office!

When we talk about expense reimbursements, the process usually involves extracting the date, amount, and breakdown from receipts, assigning the appropriate expense accounts, and compiling everything into a list. That’s manageable in small quantities, but for some people, expense reports can include dozens or even hundreds of receipts per month—which can take a lot of time to organize.

In the meantime, generative AI tools like Gemini by Google have been evolving rapidly. They’re capable of handling simple tasks and generating content surprisingly well. So, I decided to put Gemini to the test: Can it help speed up expense reimbursements?

1.Basic Test

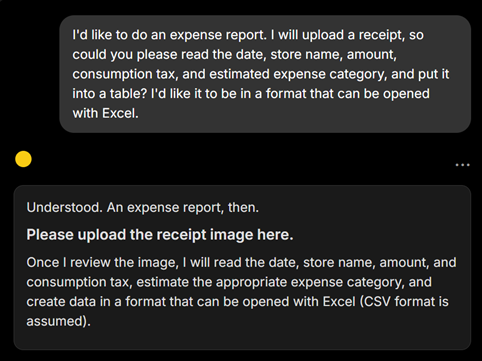

To start, I gave Gemini the following prompt, keeping the instructions intentionally vague.

Gemini responded enthusiastically, so I uploaded about ten receipt images, taken individually with a smartphone camera (from a straight angle as much as possible). If you have access to a scanner, using scanned images may give even better results.

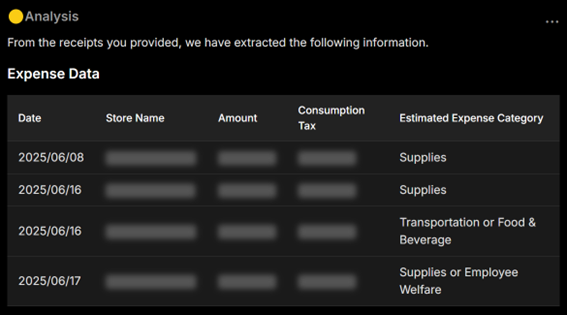

In about ten seconds, Gemini generated a neat table extracting the following information from each receipt:

・Date

・Store name

・Total amount

・Consumption tax amount

For receipts without a listed tax amount, it returned “Unknown.”

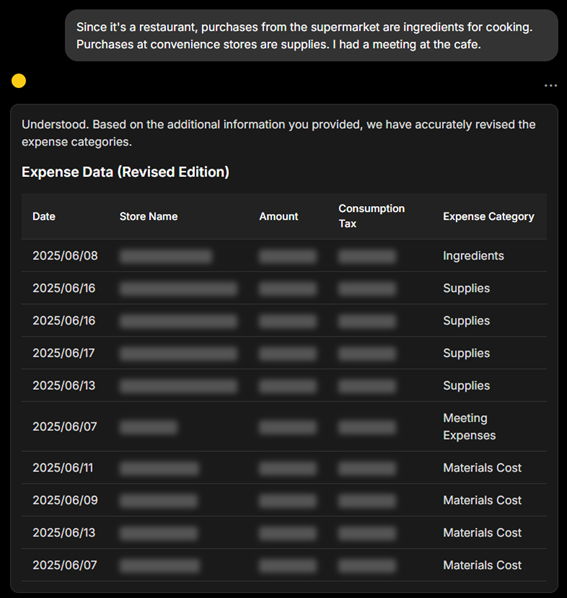

As for the expense category, Gemini seemed unsure in some cases—especially with food purchases—but once I gave it additional context (e.g., assuming it’s for a restaurant business), it adjusted the classifications accordingly.

Interestingly, even without explicitly naming chain stores or convenience stores, Gemini used store names to make reasonable guesses.

2.Testing Additional Features

I added a few more elements to test how far Gemini could go.

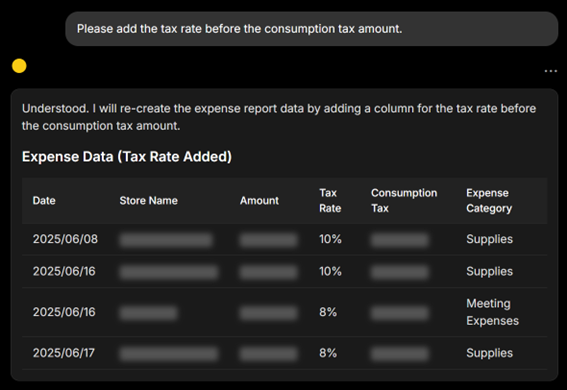

① Consumption Tax Rate

Like the tax amount, Gemini could read the tax rate if it was printed on the receipt. If not, it simply returned “Unknown.” So far, so good.

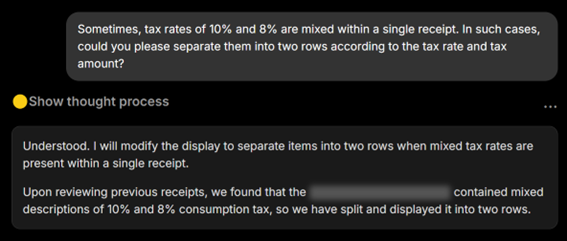

② Receipts with Mixed Tax Rates

I uploaded a receipt containing both standard (10%) and reduced (8%) tax rates.

Unfortunately, Gemini treated the entire receipt as being taxed at 10%.

I then modified the prompt to explicitly point out the presence of two rates. Gemini did attempt to split the entry into two rows, but it mistook the base amount for the tax and otherwise miscalculated the breakdown.

Depending on the receipt format, it might be possible to handle this better, but for now, it seems that mixed-rate receipts are still a challenge.

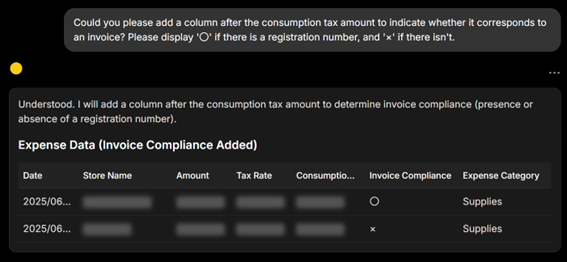

③ Invoice Eligibility Check

Gemini generally did well at identifying whether a receipt qualified as a Japanese qualified invoice (i.e., whether it had an invoice registration number).

However, there were some cases where it failed to recognize receipts that did have a valid registration number, likely due to missing or misreading the printed ID.

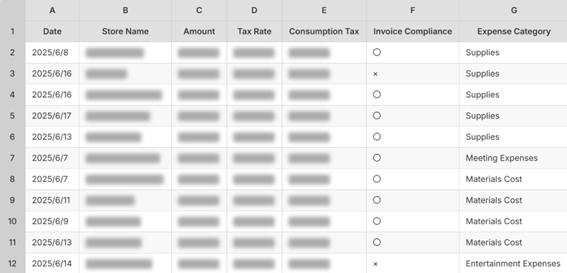

3.Exporting the Data

I instructed Gemini to output the data in a format usable in Excel. While it didn’t generate an actual Excel file, it returned a CSV-style table, which I could copy and paste into a .txt file and then import into Excel.

Gemini also offered to export the data to Google Sheets, which is likely a Gemini-specific feature.

From there, I was able to download the file in Excel format, which proved quicker and more convenient overall.

In any case, I found it quite easy to generate a usable summary.

Final Thoughts

Surprisingly, Gemini performed better than I expected.

While there are still limitations—especially in handling receipts with mixed tax rates or reliably detecting invoice IDs—the core functionality was solid. Having AI create the initial spreadsheet and then manually checking or editing a few rows is far faster than entering everything by hand. It also reduces human error.

This was just an experiment, and I gave only minimal prompts. With more specific instructions and usage over time, Gemini’s accuracy could likely improve.

There’s still room for refinement, but this test gave me a good sense of AI’s potential for streamlining back-office tasks.

I plan to try using it for other types of work in the future—and I’ll share my findings as I go.

Sample Prompt (Feel Free to Use!)

Here’s the prompt I used for this test. You’re welcome to try it yourself:

“I’d like to do an expense report. I’ll upload some receipts—please extract the date, store name, amount, consumption tax rate, tax amount, whether the receipt qualifies as an invoice, and the suggested expense category. Please display the results in a format that can be opened in Excel. If an invoice registration number is present, mark it as ‘○’, and if not, mark it as ‘×’.”

Comment

No trackbacks yet.

-200x200.jpg)

No comments yet.