Can AI OCR Really Work in the Real World? We Put It to the Test!

-800x348.jpg)

Hello, this is KS from Sayu Certified Public Accountants.

If you run a business, you probably know just how time-consuming it can be to digitize paper documents like receipts, invoices, and bank passbooks. We also deal with this issue daily as we process and manage documents received from our clients.

One solution that’s been getting a lot of attention lately is AI-powered OCR (Optical Character Recognition) technology. Many business owners are wondering:

“Could this really help automate our workflows?”

But at the same time, you may also have doubts like:

“Can it really read accurately?”

“Is it practical enough to use in our daily operations?”

While some accounting software already offers OCR functionality, there are often limitations—like monthly scan limits or per-document fees—which might discourage small businesses from trying them out.

So today, instead of focusing on accounting software, we tested the OCR features of a generative AI app to see whether it could handle real-life business documents.

1.What Is “AI-OCR” Anyway?

AI-OCR is a technology that recognizes handwritten or printed text—just like a human would—and converts it into digital data. For example, you can take a photo of a receipt with your smartphone or scan an invoice, and the system automatically extracts the date, total amount, store name, and more.

Conventional OCR systems often made frequent errors, which meant you had to correct everything manually. But with recent advances in AI, accuracy has significantly improved—at least in theory.

2. We Put It to the Test!

Now to the core of this article. In our daily work, there are two main situations where we’d really benefit from high-performing OCR:

・Reading receipts and invoices

・Digitizing bank statements and transaction logs

We tested these two use cases using the popular generative AI app, Gemini 2.5 Flash by Google.

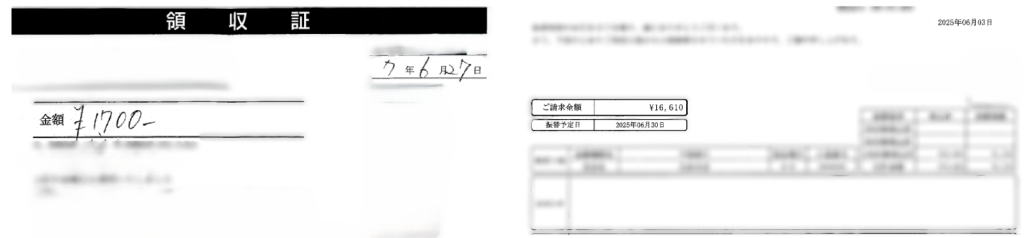

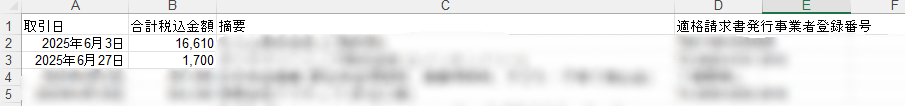

1.Scanning Receipts and Invoices

We prepared 30 different types of documents, ranging from printed receipts to handwritten invoices. We asked the AI to extract the following items:

・Date

・Total amount (tax-included)

・Description (vendor or item name)

・Qualified invoice issuer number

Results: 27 out of 30 documents were read accurately!

Surprisingly, even the handwritten invoices were recognized better than expected.

Here’s what went wrong in the remaining 3 cases:

1.One faded receipt was not recognized at all due to poor legibility.

2.One vendor name contained a rare kanji character (“惠” mistaken as “恵”)—something even humans might misread.

3.One invoice had the payment due date and issue date far apart, and the AI picked the wrong one. Layout differences can still confuse the system.

The data was output directly into a Google Spreadsheet for easy review.

2.Digitizing Bank Passbooks

Next, we tested 100 bank transactions to see if the AI could capture:

・Date

・Credit amount

・Debit amount

・Transaction details (payee or payer)

Results: 89 out of 100 entries were correctly read.

Given that bank passbooks usually lack gridlines and often have tightly packed text, we were impressed by the accuracy.

Here are the 11 errors we found:

・7 entries had minor errors in the description field—such as confusing similar katakana characters (e.g., ワ and ク, パ and バ).

・3 entries had reversed amounts—credit and debit were mixed up. This type of mistake requires extra attention.

・1 entry was completely skipped. There’s still a risk of data loss.

3.Our Honest Take on AI-OCR

After actually testing the OCR feature of a generative AI app, here’s our honest opinion:

“Wow—it’s surprisingly powerful… but not quite foolproof.”

We were genuinely impressed that around 90% of the data was read correctly, especially with handwritten documents. This level of accuracy makes AI-OCR a useful support tool in real-world workflows.

However, the errors we observed—especially the occasional reversed figures or missed entries—make it clear that human review is still essential.

So, is AI-OCR ready for full automation? Not yet.

But is it worth using as an assistant to boost productivity? Absolutely.

We believe these tools are worth exploring—especially as they continue to evolve—and we’ll keep sharing practical tips on leveraging AI in accounting workflows.

Comment

No trackbacks yet.

-200x200.jpg)

No comments yet.