- Home

- Blog

- 【Using freee Apps】 My Impressions of the Closing Support App and the Foreign Currency Transaction Management App

【Using freee Apps】 My Impressions of the Closing Support App and the Foreign Currency Transaction Management App

-800x348.jpg)

Hello, this is SN from Sayuu Certified Public Accountant Office.

The cloud-based accounting software freee offers an app store with various extensions to help streamline accounting tasks. In this article, I would like to share my impressions after trying out two apps: the Closing Support App, which assists with year-end closing tasks, and the Foreign Currency Transaction Management App, which supports foreign currency conversion. I hope this review will be of some help to current freee users or those considering its implementation.

1. Closing Support App

The Closing Support App provides guidance on the procedures necessary for year-end closing. In the initial steps, it prompts users to confirm the accounting period, register bank accounts and credit cards, and record all transactions for the year. Then, it moves on to checks such as duplicate transaction detection, credit card reconciliation, bank balance checks, and closing adjustments (such as fixed asset ledger checks and negative balance checks).

In short, when users are unsure about “What exactly should I do to get ready for closing?”, the app walks them through the process step by step.

(Image caption: Workflow of the Closing Support App)

That said, the app essentially works by issuing alerts when it detects suspicious figures (e.g., negative balances, mismatched balances) or transactions that meet certain criteria (e.g., possible duplicates), and then navigates users to the relevant correction pages. The actual corrections, however, must be made by the users themselves.

For example, duplicate transaction detection is based on a fixed condition such as: “same month, same account title, same business partner, and similar amount.” As a result, many false positives appeared. If users could customize the search conditions (e.g., “same date and same amount”), the functionality would be more effective.

What I found particularly useful was the bank balance check. When the actual bank balance differs from the registered balance in freee, the app raises an alert and directs users to the Timeline page. There, it shows exactly on which date the discrepancy arose, making it easy to pinpoint the source of the mismatch.

(Image caption: Alert for bank balance check)

(Image caption: freee Timeline page)

One important observation is that some items are not covered by the app’s checks—for instance:

• Ensuring capital expenditures are not recorded as expenses

• Verifying consumption tax classifications

Therefore, it is difficult to complete closing solely by relying on this app. My honest impression is that it functions better as a supplementary tool for companies that handle their own bookkeeping to prepare for closing. Since it covers key tasks such as bank reconciliation, using it beforehand could make communication with accountants smoother during the year-end closing process.

2. Foreign Currency Transaction Management App

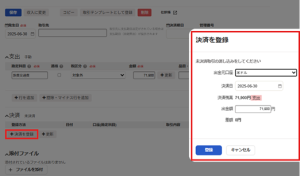

The Foreign Currency Transaction Management App converts foreign currency transactions into JPY and registers them in freee. From the “Foreign Currency Transaction Entry” menu, users can perform transaction-date conversions, and from the “Year-End Evaluation” menu, they can revalue foreign-currency-denominated receivables and payables at the year-end rate.

Both functions automatically fetch exchange rates and perform calculations, eliminating the need to manually source FX rates. Supported currencies are also extensive, covering all major ones.

(Image caption: Menu of the Foreign Currency Transaction Management App)

(Image caption: Supported currencies list)

However, while the app allows transaction-date conversion and revaluation of receivables/payables, it does not provide functionality to revalue foreign currency cash holdings at year-end. Users must calculate this manually and record the adjusting entries themselves.

If foreign currency is used directly for payments rather than through receivables/payables, users can first record the liability as “Accounts Payable” and then immediately settle it on the same day. This effectively treats the payment as being made in foreign currency at that day’s rate.

Additionally, by creating a dedicated “USD Account” (or similar) in freee, users can record FX transactions and track pre-revaluation balances. This makes it easier to calculate foreign currency holdings at year-end rates and to recognize foreign exchange gains/losses.

Since the app allows only one account to be designated for exchange differences, either “Foreign Exchange Gains” or “Foreign Exchange Losses” must be selected. If the final balance turns negative, a reclassification to the opposite account is necessary.

(Image caption: Transaction entry screen)

(Image caption: Post-entry transaction screen)

(Image caption: Settlement entry screen)

Although it was disappointing that the app lacks an automatic year-end conversion for foreign currency holdings, I believe it is still highly valuable for businesses with frequent foreign currency transactions or foreign currency receivables/payables.

________________________________________

Final Thoughts

This time, I tried out two apps from freee’s App Store. Since there are many other apps available, I would like to explore more in the future if I come across something interesting.

https://app.secure.freee.co.jp/applications/7862 Closing Support App

https://app.secure.freee.co.jp/applications/2888 Foreign Currency Transaction Management App

Comment

No trackbacks yet.

-200x200.jpg)

No comments yet.