- Home

- Cloud accounting software

- Cloud Accounting Review: Account Breakdown and Tagging in freee and Money Forward

Cloud Accounting Review: Account Breakdown and Tagging in freee and Money Forward

Hello from Sayu CPA Office!

Welcome to the third post in my ongoing series of personal reviews on cloud-based accounting software. This time, I’ll be comparing how freee and Money Forward handle a key feature for growing businesses: organizing account details.

As your business scales, you may find that simply using general account titles is no longer enough. You might want to break down balances into more detailed subcategories—for example, to see the breakdown of deposits or liabilities. Both freee and Money Forward offer features to address this, each with its own approach.

________________________________________

Money Forward

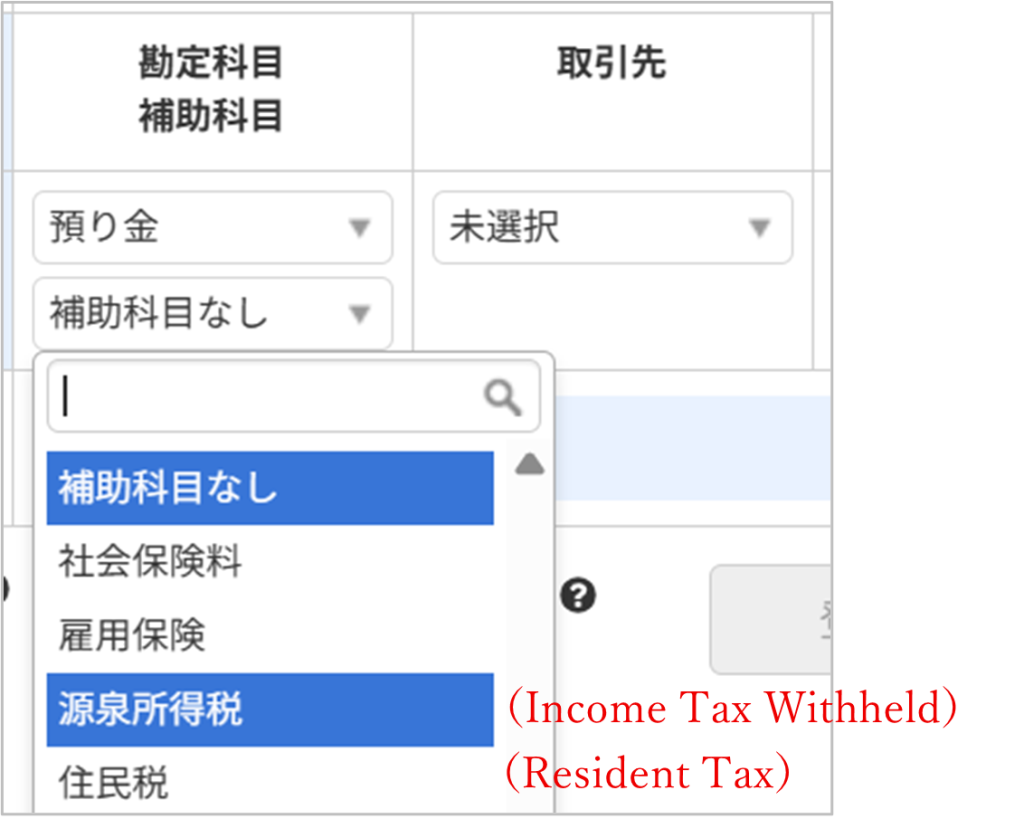

The main tool in Money Forward for managing account breakdowns is the sub-account (補助科目), which is a familiar concept in traditional Japanese accounting software.

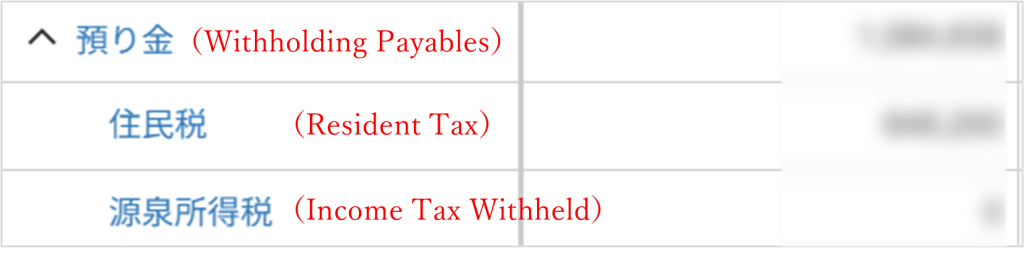

Think of it as a parent-child relationship: for example, under the main account “Withholding Payables,” you might create sub-accounts such as “Income Tax Withheld” and “Resident Tax.” When recording a journal entry, you first select the main account, then choose a sub-account from a dropdown menu. Only one sub-account can be assigned per journal line.

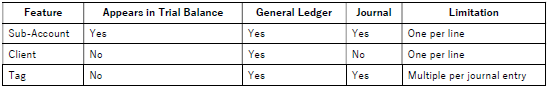

Since sub-accounts appear in trial balances, assigning them at the time of entry allows you to easily review both the overall balance and its breakdown. Sub-accounts can also be used as filters in the general ledger and journal.

If you want to track transaction details without displaying them in the trial balance, you can also use Clients(取引先) or Tags(タグ):

・Clients can be registered in advance and selected from a dropdown menu during data entry. They are searchable in the general ledger (though not currently in the journal). Like sub-accounts, only one client can be assigned per line. For companies with a few key customers or vendors, this can be a helpful way to group and search transactions.

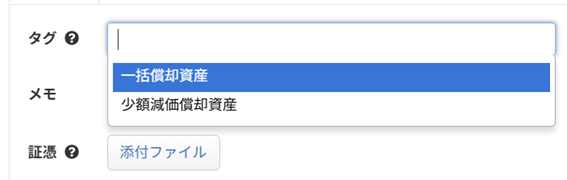

・Tags offer the most flexibility. They can be used as search filters in both the general ledger and journal, and multiple tags can be attached to a single transaction (for journal entries with multiple lines, tags apply to the entire entry). Unlike sub-accounts or clients, tags aren’t tied to a specific purpose, so you can use them freely—for example, to track products, departments, or even counterparties. Just be cautious: if you tag too many things without a clear system, your tag list may become cluttered and unmanageable.

Personally, I use tags when recording assets between ¥100,000 and ¥300,000, marking them with labels like “Small Asset Depreciation(一括償却資産、少額減価償却資産)” so I can easily find them during closing.

Here’s a quick summary:

________________________________________

freee

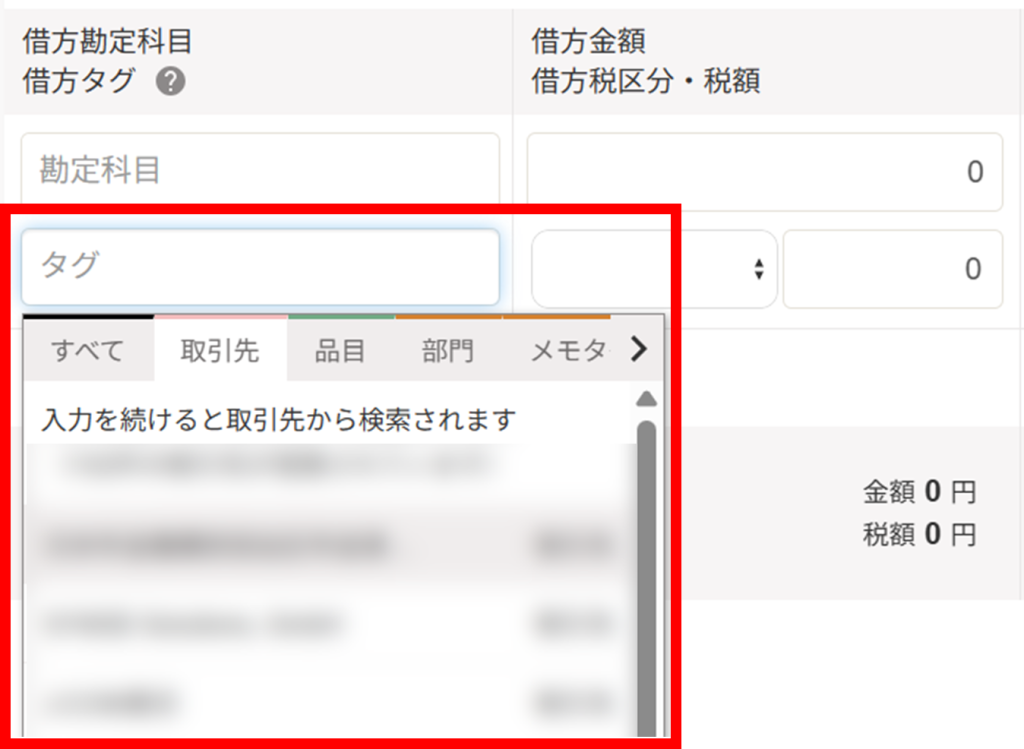

In contrast to Money Forward, freee does not use sub-accounts. Instead, all account organization is done through tags(タグ)—which are classified into four types:

・Client Tag(取引先タグ) – for identifying transaction counterparties

・Item Tag(品目タグ) – for grouping by goods, services, or content

・Department Tag(部門タグ) – for separating by division, branch, or office

・Memo Tag(メモタグ) – for adding free-form notes (not displayed in reports)

(Note: Tag features may vary depending on your subscription plan.)

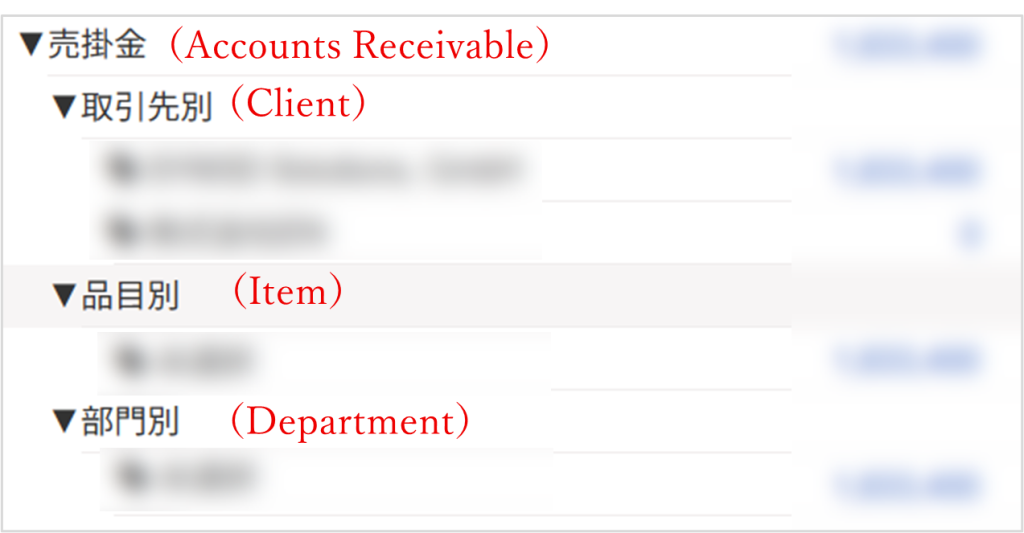

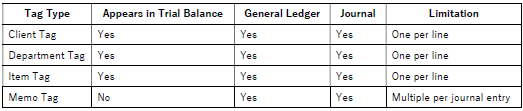

Of the four, Client, Item, and Department Tags appear in the trial balance, while Memo Tags do not. Memo Tags are primarily useful as internal search keywords.

freee allows you to assign one of each tag type to a single transaction line. For example, one journal line could include a Client Tag + Item Tag + Department Tag + Memo Tag. (You can even assign multiple Memo Tags.) Tags are pre-registered and selected at the time of entry from the transaction or journal entry screen.

This structure enables multi-dimensional tracking. For example, for Accounts Receivable:

・Client Tags show who owes money

・Department Tags show which department is responsible

・Item Tags show what category of product or service was sold

However, as with tags in Money Forward, this flexibility comes with a risk: if you overuse tags without a clear system, your tag library can quickly become overwhelming and hard to manage. For example, if you tag every small office supply purchase with both vendor and product tags, it may not provide any real benefit and just clutter the system.

Before assigning tags, it’s important to ask: Is this account worth breaking down further? If so, what kind of categorization will actually help during review or reporting?

Here are a few ways I personally use freee tags:

・For Accounts Receivable, Accounts Payable, Sales, and Purchases, I use Client Tags to identify the counterparty.

・For Withholding Payables, I use Item Tags like “Income Tax Withheld” or “Resident Tax” to separate the balance.

・For Loans, I use Client Tags to label the bank name, and if there are multiple loans from the same bank, I add an Item Tag such as “Loan – ¥5M” to indicate the amount.

・For Expenses such as office supplies or utilities, I usually don’t assign any tags.

・Memo Tags are rarely used unless I need to temporarily flag a transaction with uncertain details.

Quick summary of freee’s tags:

________________________________________

Final Thoughts

When it comes to organizing account details, both Freee and Money Forward offer powerful and practical features. Once you understand how to use them, they can significantly improve the clarity of your accounting data.

More importantly, the real value comes from how you use these tools. I recommend starting simple—use just one sub-account in Money Forward or one tag type in Freee. Once you’re comfortable, you can gradually expand your setup to fit your reporting needs.

At Sayu CPA Office, we support businesses in implementing and making the most of both cloud-based and desktop accounting software (like Yayoi). If you’re looking to introduce or optimize your accounting system, feel free to reach out for a consultation.

Comment

No trackbacks yet.

No comments yet.