- Home

- Blog, Cloud accounting software

- Cloud Accounting Software Review: Invoice Compliance & Support Functions

Cloud Accounting Software Review: Invoice Compliance & Support Functions

Hello, this is S from Sayu Certified Public Accountants.

With the introduction of Japan’s Invoice System, accounting tasks now require not only checking consumption tax rates and amounts, but also verifying whether a transaction involves a Qualified Invoice. When registering journal entries or reviewing work, it is essential to keep this in mind and ensure the information is entered correctly into the accounting software.

In this article, we will compare how freee, Money Forward, and the desktop-based Yayoi Accounting handle Qualified/Non-Qualified Invoice inputs, and also introduce some supplementary and management functions that help ensure accurate data entry.

Yayoi Accounting

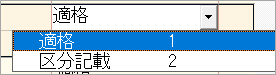

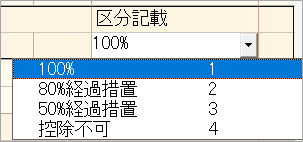

When entering journal entries, Yayoi provides a dedicated input field for invoice compliance. Users select (1) Qualified or Transitional Invoice, and (2) Deduction Rate, both from dropdown menus.

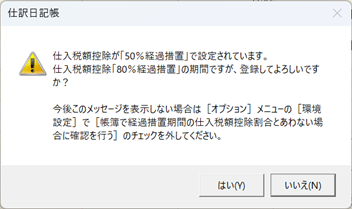

Currently, the transitional deduction rate is 80%, but it is scheduled to decrease to 50% and eventually 0% over the next few years, and Yayoi has already incorporated these changes.

While dropdown menus make it possible to mistakenly select the wrong deduction rate, the system issues an alert if the selected rate does not match the applicable period (depending on environment settings). In practice, deduction rates only change around specific transition months, so it might be more efficient if the software automatically applied the correct rate based on the date, rather than always presenting all options.

Yayoi does not include a function for managing invoice numbers. Since entering invoice numbers into accounting software is not legally required, this is considered sufficient functionality. For those who prefer to confirm invoice numbers without referring back to the original invoices, a more practical approach might be to manage them separately in procurement/sales software or even in Excel. Given that Yayoi’s user base is mainly small businesses, this may not be a significant issue.

Overall, Yayoi Accounting has added only the minimum functions required for invoice compliance, while keeping the familiar data-entry style largely unchanged. For long-time Yayoi users, this lack of drastic changes is likely seen as a positive point.

freee

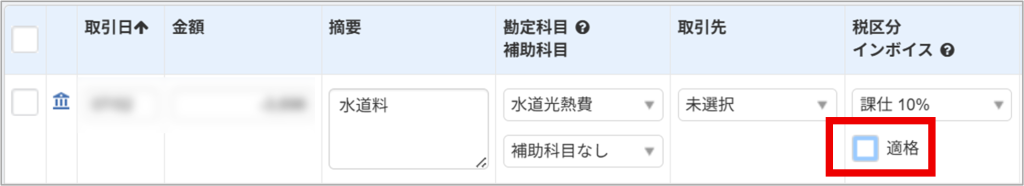

In freee, the method depends on the entry screen. In the “Automated Bookkeeping” (transaction registration) screen, users first select the tax rate, then mark the transaction as “Qualified” if it is based on a Qualified Invoice. If not, the checkbox is left blank. The presence or absence of the checkmark automatically switches the tax category between “Taxable Purchase” and “Taxable Purchase (Deduction 80%).”

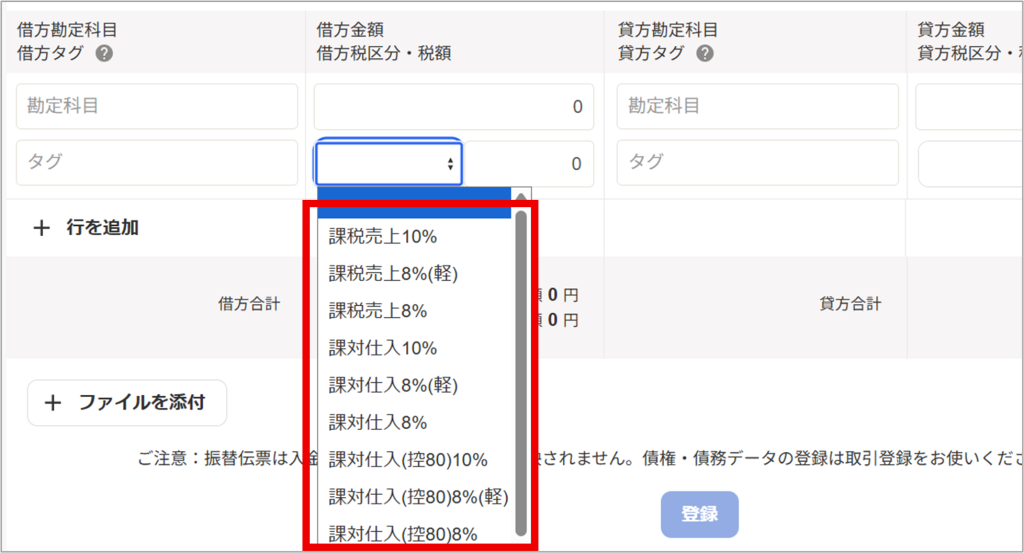

On the other hand, when using the journal entry (transfer slip) screen, users must select from tax rates that are already categorized by Qualified/Transitional status. This difference in entry style across screens can be confusing for new users.

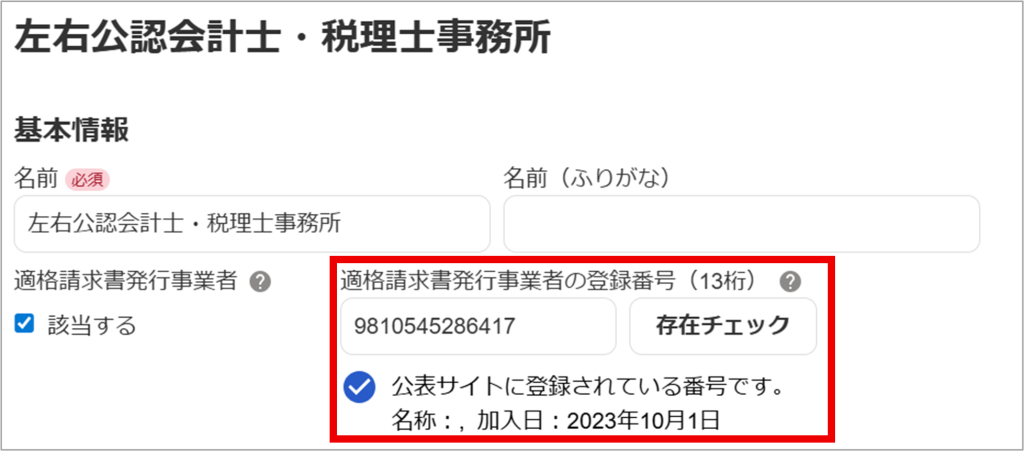

freee also allows invoice numbers to be managed internally. When registering a business partner tag, users can link the invoice number, so that when the tag is selected during entry, the stored information is automatically reflected. In addition, freee provides a function to verify invoice numbers against the National Tax Agency’s public registry, both at the time of registration and later from the list view. For companies dealing with multiple business partners, this significantly reduces the administrative burden. While it may not be necessary to register every minor supplier, doing so for major vendors could make management much easier.

Money Forward

Money Forward’s approach is similar to freee’s but more consistent in terms of user interface. On all input screens, users simply check “Qualified” if the transaction is based on a Qualified Invoice, or leave it unchecked if not. Unlike freee, the operation method does not change depending on the screen, which is a point I personally appreciate about Money Forward’s interface design.

One drawback is that the transitional deduction percentage is not shown before registration, only after the transaction is saved, when the applicable percentage based on transaction date is displayed.

Like freee, Money Forward allows invoice numbers to be registered with business partners and verified against the National Tax Agency’s database. The stored information is automatically reflected during entry when the business partner is selected. Functionally, there is little difference from freee.

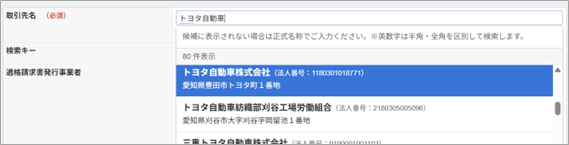

Additionally, Money Forward offers a convenient feature when registering business partners: users can search by name, and if the partner is a corporation, the information can be pulled directly from the Corporate Number Publication Site. (Note: this does not work for sole proprietors.) This makes registration significantly faster.

Comparison & Impressions

From this comparison, both freee and Money Forward clearly offer more automation and management features for invoice compliance, making them well-suited for practical use. Yayoi, while covering the basics, leaves more responsibility to the user when it comes to settings and invoice number management, resulting in less convenience compared to the cloud-based systems. However, Yayoi still excels in the speed and smoothness of bulk data entry, which may appeal to users focused primarily on input efficiency.

Ultimately, the choice depends on each company’s scale and workflow. Since the Invoice System requires high accuracy for each transaction, even small differences in software functionality and support can greatly affect the workload of accounting staff. Selecting software that fits your company’s processes will help minimize errors and maintain an efficient accounting system.

At our firm, we support both desktop-based and cloud-based accounting software, assisting clients with both implementation and effective usage. If you would like advice on choosing the right software for your business, please feel free to contact us.

Comment

No trackbacks yet.

-200x200.jpg)

No comments yet.